This article briefly describes the reduction of official fees (examination fees and patent maintenance fees) for small and medium-sized enterprises (SMEs), Startups, and sole proprietors in Japanese patent applications.

Firstly, if an applicant is an SME, Startup, or sole proprietor, it may benefit from the reduction of examination fees and patent maintenance fees (the 1st to 10th years).

In particular, the examination and patent maintenance fees can be reduced to 1/3 or 1/2 depending on the number of employees, capital, and the number of years of establishment.

The examination and patent maintenance fees in Japanese patent applications are briefly described below.

Examination Fees

The examination fees for patent applications filed on or after Apr. 1, 2019 are as follows.

| Types of patent applications | Examination fees (JPY) |

|---|---|

| Direct patent application, including Paris route | 138,000 JPY + (The number of claims x 4,000 JPY) |

| PCT-JP National Stage Entry wherein International Search Report (ISR) has been prepared by the JPO | 83,000 JPY + (The number of claims x 2,400 JPY) |

| PCT-JP National Stage Entry wherein ISR has been prepared by a search authority other than the JPO | 124,000 JPY + (The number of claims x 3,600 JPY) |

For example, if the number of claims is 10 in a PCT-JP national stage entry wherein ISR has been prepared by a search authority other than the JPO, the examination fees are 160,000 JPY (equivalent to about 1,100 USD at USD/JPY rate = 145).

Patent Maintenance Fees

The patent maintenance fees for patent applications wherein a request for examination was filed on or after Apr. 1, 2004 are as follows. Note that patent maintenance fees mean maintenance fees to maintain a patent.

| Duration | Patent Maintenance Fees (JPY) |

|---|---|

| The 1st to 3rd years (for each year) | 4,300 JPY + (The number of claims x 300 JPY) |

| The 4th to 6th years (for each year) | 10,300 JPY + (The number of claims x 800 JPY) |

| The 7th to 9th years (for each year) | 24,800 JPY + (The number of claims x 1,900 JPY) |

| The 10th to 25th years (for each year) | 59,400 JPY + (The number of claims x 4,600 JPY) |

For example, if the number of claims is 10 in a patent application wherein a request for examination was filed on or after Apr. 1, 2004, the patent maintenance fees for the 1st to 10th years are 313,600 JPY in total (equivalent to about 2,160 USD at USD/JPY rate = 145). The patent maintenance fees for each year are 105,400 JPY on or after the 10th year.

The patent maintenance fees for over the 10th year are set to be higher since such a patent maintained for more than 10 years is assumed as highly valuable to a patentee.

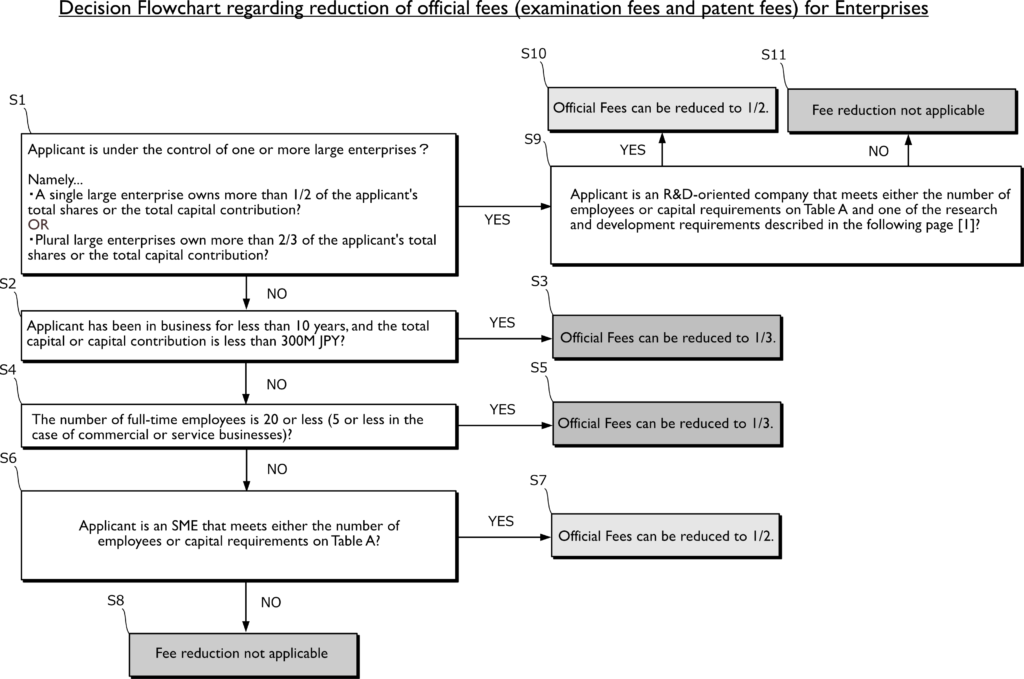

Next, we will show respective decision flowcharts for the reduction in official fees for enterprises (SMEs and Startups) and Individuals (sole proprietors) as follows.

Decision flowchart for Enterprises

Practically, the fee reduction requirements for enterprises are limited to the following as shown in the flowchart. Note that we do not describe the fee reduction for universities herein, which will be able to enjoy 1/2 fee reduction irrespective of nationalities.

| Type of Industry | Number of regular employees | Capital or Total Investments received | |

| (a) | Manufacturing, construction, transportation, and other industries (excluding industries listed in (b) to (g)) | 300 or less | 300M JPY or less |

| (b) | Wholesale | 100 or less | 100M JPY or less |

| (c) | Service (excluding industries listed in (f) and (g)) | 100 or less | 50M JPY or less |

| (d) | Retail | 50 or less | 50M JPY or less |

| (e) | Manufacture of rubber products (except manufacture of tires and tubes for automobile or aircraft; and manufacture of industrial belts) | 900 or less | 300M JPY or less |

| (f) | software or information processing service | 300 or less | 300M JPY or less |

| (g) | Hotel | 200 or less | 50M JPY or less |

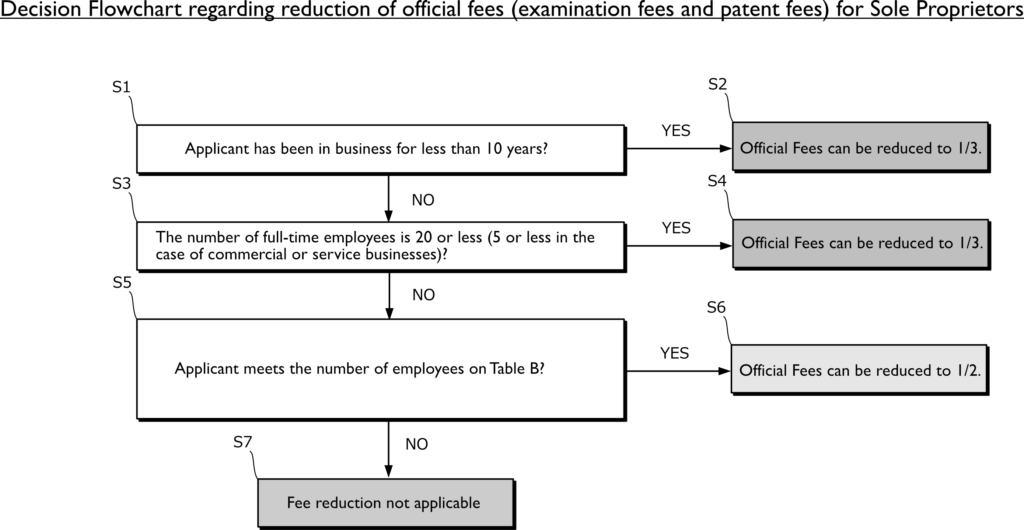

Decision flowchart for Sole Proprietors

Practically, the fee reduction requirements for sole proprietors are limited to the following as shown in the flowchart. It should be noted that individuals who do not do business by themselves are not eligible for fee reduction.

| Type of Industry | Number of regular employees | |

| (a) | Manufacturing, construction, transportation, and other industries (excluding industries listed in (b) to (g)) | 300 or less |

| (b) | Wholesale | 100 or less |

| (c) | Service (excluding industries listed in (f) and (g)) | 100 or less |

| (d) | Retail | 50 or less |

| (e) | Manufacture of rubber products (except manufacture of tires and tubes for automobile or aircraft; and manufacture of industrial belts) | 900 or less |

| (f) | software or information processing service | 300 or less |

| (g) | Hotel | 200 or less |

The document regarding reduction of official fees can be downloaded from here.

Disclaimer: While IPStart makes every effort to ensure the accuracy of the information, it does not guarantee or give any warranty as to the accuracy, timeliness or completeness of any information or material on our website.